Challenge

Retailers rely on Thokmandee to stock up on inventory from international brands. While bulk purchasing helps them secure better pricing and product availability, it also creates a significant cash flow challenge. Retailers must pay for their orders immediately, yet they only generate revenue once products are sold, which is often weeks later. This liquidity gap limits their ability to place larger orders, constraining both their growth and Thokmandee's overall transaction volume.

"For retailers managing inventory needs and cash flow can be a delicate balancing act. Upfront payments have been a known bottleneck as many would like to buy more but are held back by cash flow constraints. Finding a way to bridge this gap became critical to unlocking growth — for them and for us," says Abbas M. Hanjra, the CEO of Thokmandee.

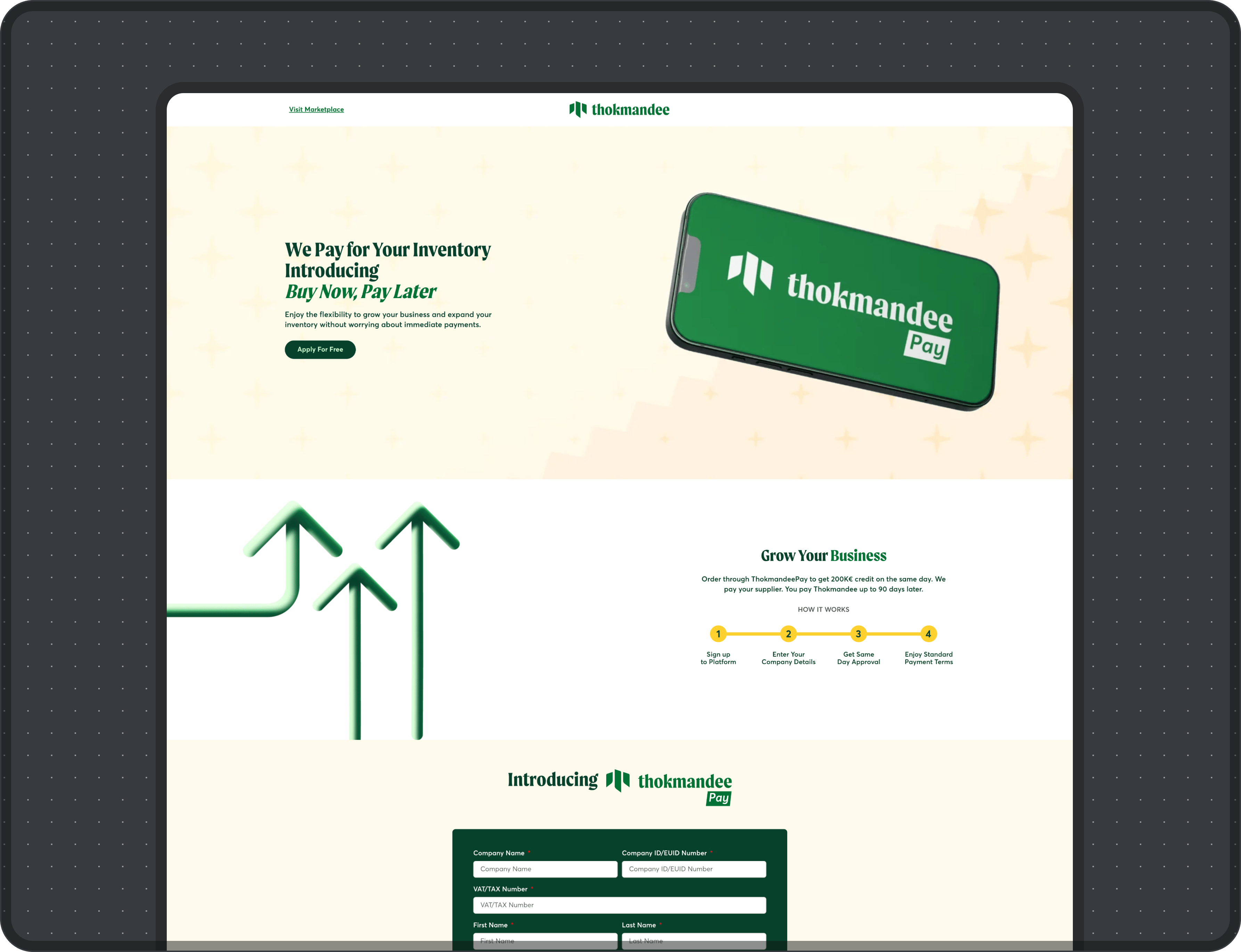

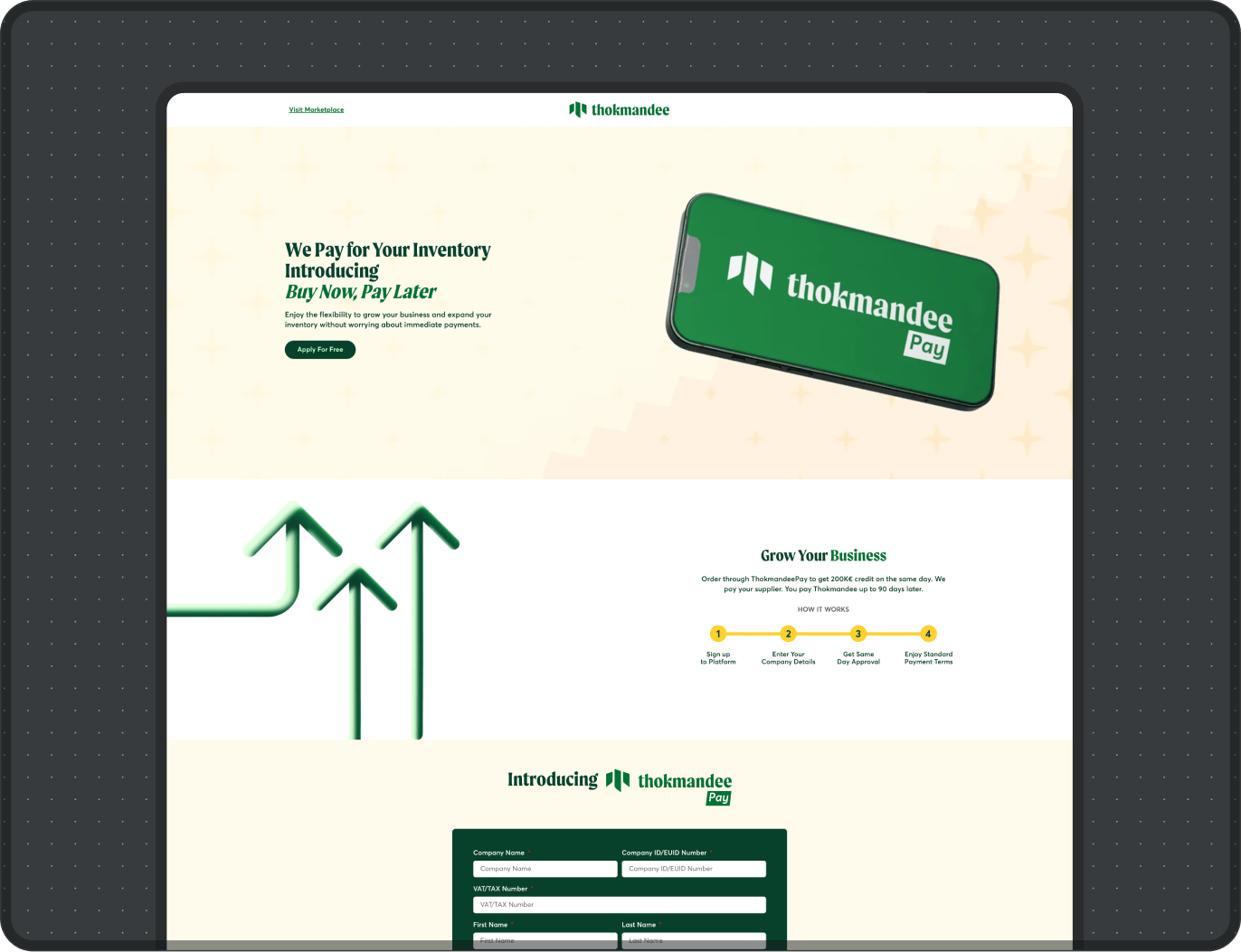

Solution

Thokmandee partnered with finmid to introduce ThokmandeePay, a Buy Now, Pay Later solution that offers flexible payment terms. Retailers can now pay for their purchases up to 90 days after receiving their goods, improving cash flow and enabling larger order volumes. Benefits include:

-

•

90-day payment terms: Retailers can defer payments for up to 90 days instead of paying upfront, easing cash flow constraints.

-

•

EEA-wide coverage: Payment terms are available to all buyers on the marketplace, regardless of their location.

-

•

Same-day buyer onboarding: Buyers can access ThokmandeePay instantly with same-day onboarding and no action required from the buyer.

-

•

10-day go-live: Thokmandee launched ThokmandeePay in just 10 days without any technical effort, using finmid’s ready-to-use dashboard.

“ThokmandeePay has been a game-changer for our buyers. By removing cash flow constraints, we have seen them place larger orders with confidence, fueling growth for both them and our marketplace. The impact has been clear — bigger order sizes, higher trading volumes, and a stronger ecosystem.”

Results

Since launching ThokmandeePay, retailers have been able to place larger orders without immediate cash flow constraints. Nine months into the partnership, the average order size through the finmid-powered solution has increased by 31%, driving higher trading volumes on Thokmandee’s platform and accelerating business growth.

With 87% of buyers across 30 EEA countries eligible for financing, ThokmandeePay has become a widely accessible and impactful solution, empowering retailers to stock up on inventory with greater flexibility.

Thokmandee is a leading online B2B wholesale marketplace that connects retailers with brands across 30+ European countries. Headquartered in Spain, the platform enables 500+ retailers to source wholesale products from a network of over 20,000 brands. Learn more on Thokmandee.

finmid is the embedded lending infrastructure powering platform growth. With its API, finmid enables platforms to launch tailored financing products for their business customers at scale. Across industries, borders, and business models, finmid drives revenue, improves retention, and fuels core business growth. finmid is trusted by Europe’s most ambitious platforms, including Wolt, Delivery Hero, Just Eat Takeaway, Glovo, and FREENOW. Learn more at finmid.com.