When the cash register becomes a bank branch: ready2order and finmid make financing possible directly at the POS

December 3, 2025, Berlin: Small and medium-sized businesses often wait weeks for bank loans, if they get them at all. However, liquidity shortages can arise overnight, especially in the restaurant and retail sectors: broken refrigerators, last-minute inventory purchases, staffing needs, or seasonal fluctuations leave no time for lengthy bank processes. Traditional financing options are often too slow, too complex, and simply not built for small businesses.

From cash register to bank account in 48 hours

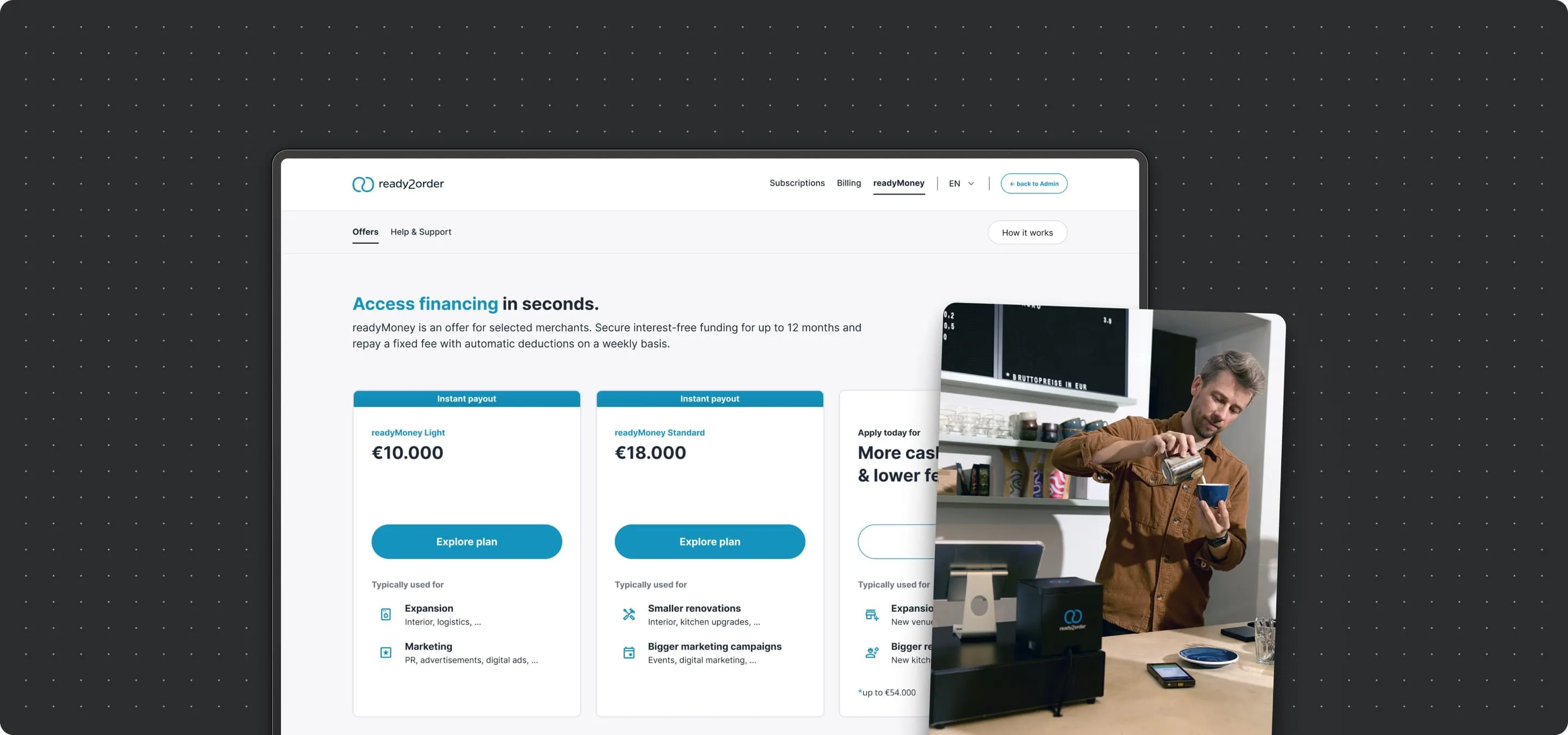

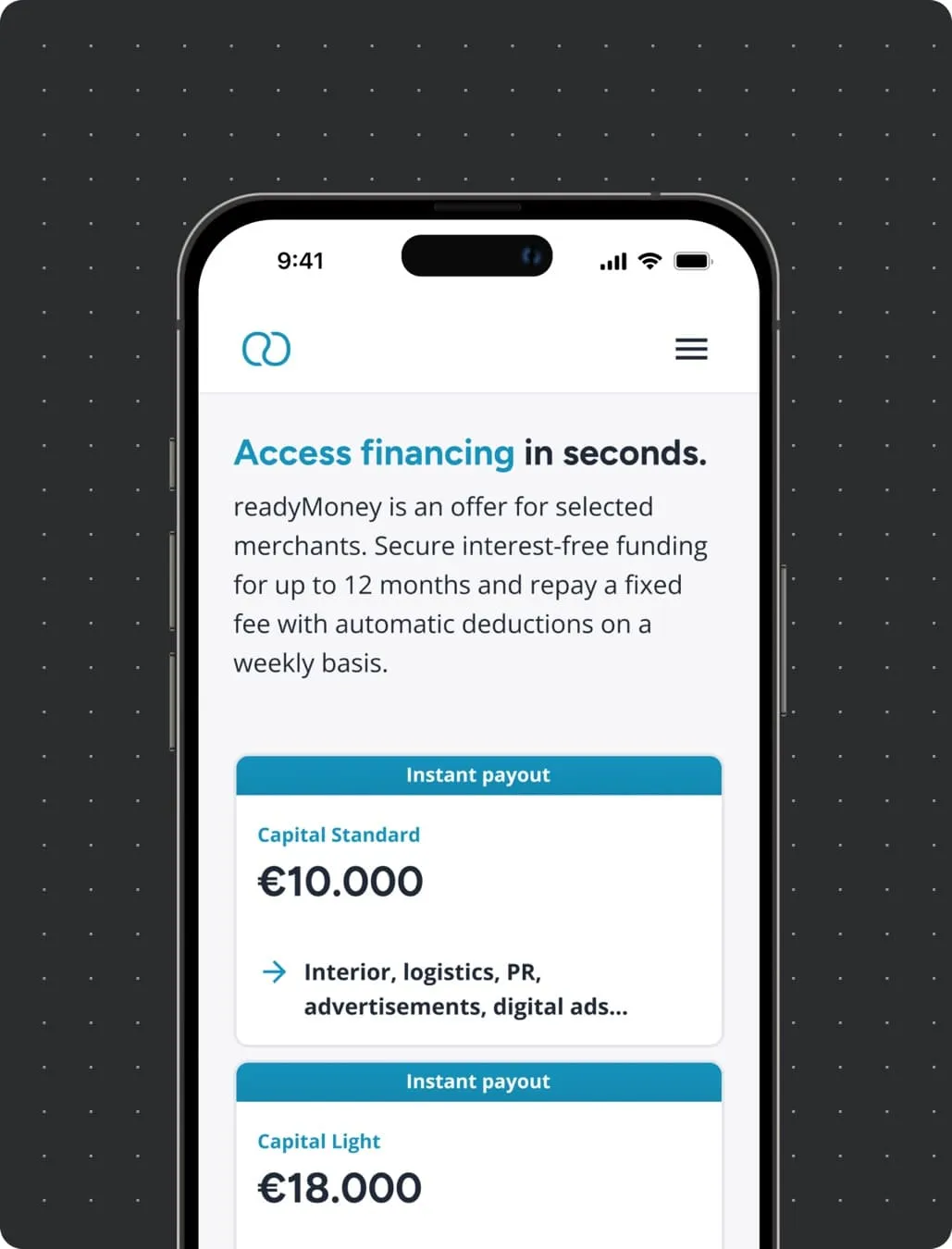

Austrian POS provider ready2order and German financial technology company finmid are closing exactly this gap: with the integration of finmid's embedded finance infrastructure, ready2order's POS system transforms in a financing platform right at the point of sale. With readyMoney, retailers and hospitality businesses can access simple, fast, and fully digital financing directly through their POS system for the first time.

Users of a ready2order POS automatically see personalized, pre-approved financing offers in their account dashboard. To receive an offer, a business must have actively used the ready2order POS system for at least one year. From there, they can choose between multiple financing amounts and repayment options. Once an offer is accepted, a brief final review is carried out, after which the amount is transferred to the account within 48 hours. Repayment follows a fixed schedule, allowing for clear planning.

“Unlike traditional banks, the ready2order POS system allows us to actively offer tailored financing without lengthy applications or tedious paperwork. At the same time, we reach entrepreneurs in an environment that is familiar to them and that they use every day: the cash register is usually the first thing switched on in the morning and one of the last things turned off before going home,”

explains Max Schertel, Co-founder of finmid.

Strong demand in the first weeks

Within the first two months since launch, hundreds of businesses have already taken advantage of financing for modernization, new equipment, expansion, staffing, or marketing. In total, offers amounting to €190 million were extended.

“The initial results clearly show how great the financing need is among small business owners. This stems from a gap in traditional offerings that affect small businesses like cafés, craft companies, and beauty salons. At the same time, we see tremendous openness to fast and uncomplicated solutions, even if they are offered in an unusual place like the POS system. The fact that readyMoney addresses precisely this issue also confirms our ambition to help small businesses get paid faster,”

emphasizes Markus Bernhart, CEO of ready2order.

readyMoney resonates with small businesses

Entrepreneurs who have already used readyMoney report very high satisfaction. The Net Promoter Score of 81 indicates high willingness to recommend the product to others. Users highlight the ease of use, fast turnaround, and fully digital experience.

For example, a restaurant owner from Tyrol used a €30,000 readyMoney financing in early November to expand his kitchen equipment with a smoker and additional grills. He discovered the offer directly in his POS interface and described the process as surprisingly straightforward:

"I had been wanting to expand my restaurant for a while, so I tried the offer right away. The process was surprisingly simple. After submitting my information, the money was in my account within 24 hours. Getting financing so quickly and easily was a new experience for me."

“Banks have large pools of capital but often do not deliver it efficiently to small businesses. With its simple user interface and accurate real-time data, ready2order and readyMoney create a platform that gives SMEs much more immediate access to financial services,”

says Max Schertel, Co-Founder of finmid.

ready2order develops and distributes cloud-based POS and payment solutions for small businesses. Since 2015, ready2order has specialized in developing and distributing innovative POS and payment solutions for small businesses across all industries. Over 16,000 businesses in Germany, Austria, and Switzerland already use ready2order successfully, relying on modern, cloud-based technology to manage their business processes. With a clear focus on speed of application, service, and development, ready2order stands for digital solutions that are user-friendly, future-proof, and ready for use at any time. Since July 2023, ready2order has been part of the Zucchetti Group, a leading European IT company from Italy with over 9,000 employees. Zucchetti offers a unique product portfolio ranging from POS, cashless payment, ERP, and HR to access control and more, specifically tailored to different company sizes and industries. More at www.ready2order.com .

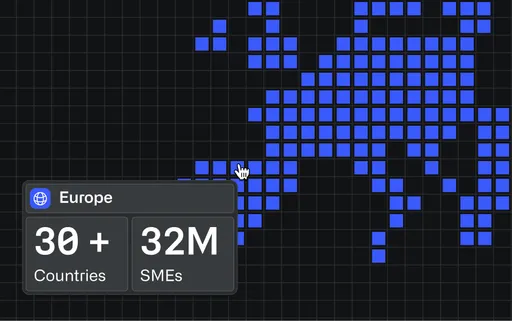

finmid is the embedded lending infrastructure powering platform growth. With its API, finmid enables platforms to launch tailored financing products for their business customers at scale. Across industries, borders, and business models, finmid drives revenue, improves retention, and fuels core business growth. finmid is trusted by Europe’s most ambitious platforms, including Wolt, Delivery Hero, Just Eat Takeaway, Glovo, and FREENOW. Learn more at finmid.com.